In 2021, it led the world in EV sales, with a total of about 2.3 million units sold, and analysts expect that trend to continue in the coming years. As governments push forward with transportation network electrification and energy storage initiatives as a means to combat climate change, copper demand from this segment is expected to surge.Įurope is becoming a strong hotbed for copper use as its renewable energy sector grows. However, the biggest driver of copper consumption in the renewable energy sector is rising global demand for electric vehicles (EVs), EV charging infrastructure and energy storage applications. Industrial production and construction activity in the Asian nation have been like rocket fuel for copper prices.Īdditionally, copper’s conductive properties are increasingly being sought after for use in renewable energy applications, including thermal, hydro, wind and solar energy. In recent decades, copper price spikes have been strongly tied to rising demand from China as the economic powerhouse injects government-backed funding into new housing and infrastructure. Rising demand for new homes and home renovations in both Asian and western economies is expected to support copper prices in the long term. In fact, construction is responsible for nearly half of global copper consumption. The ever-growing number of copper uses in everyday life - from building construction and electrical grids to electronic products and home appliances - make it the world’s third most-consumed metal.Ĭopper’s anti-corrosive and highly conductive properties are why it’s the go-to metal for the construction industry (for example, in copper pipes and copper wiring). Robust demand has long been one of the strongest factors driving copper prices. What key factors drive the price of copper?

Chile is the world’s largest copper miner, producing more than 5.8 million tons of metal annually. With regard to supply, copper mining is mainly concentrated in Latin America. While the recycling of old copper helps meet about 45 per cent of global needs, rapidly increasing consumption requires continued development of new metal resources.

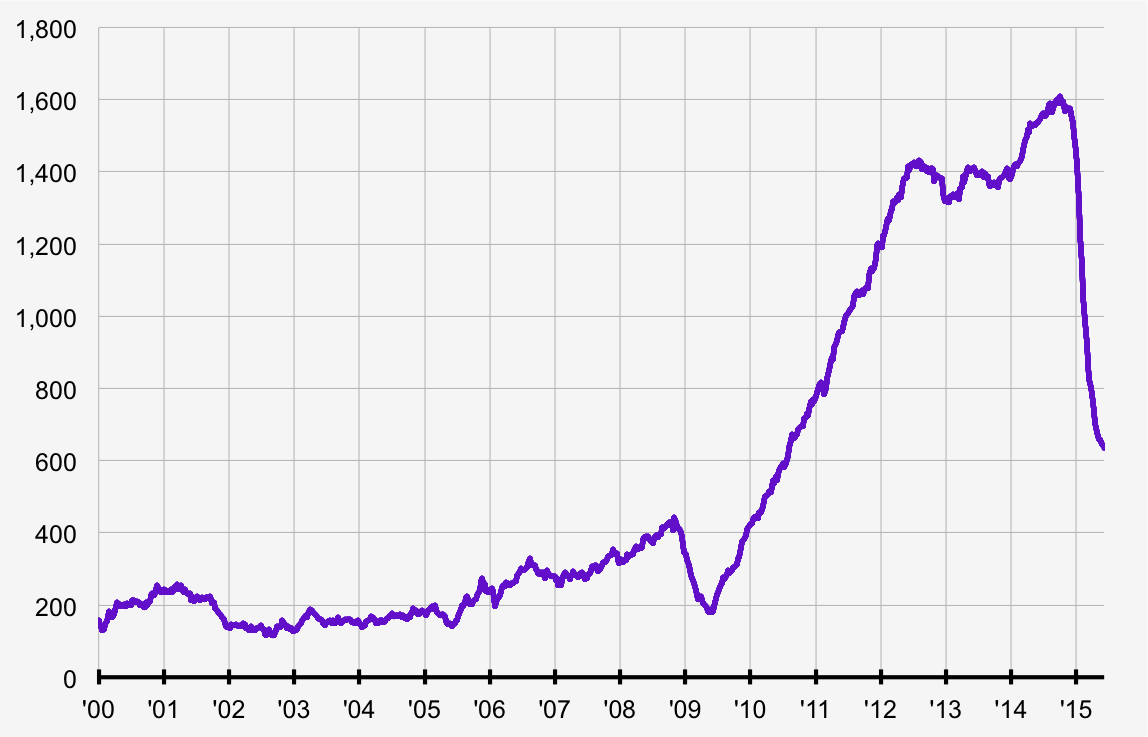

In 2018, the worldwide consumption of copper reached 23.6 million tons a year and is expected to hit 29.8 million tons by 2027. China, with its huge manufacturing sector, is by far the biggest consumer of the metal in the world. More than 60 per cent of overall copper consumption occurs in Asia. It has a high electrical conductivity, second only to silver, making it a very attractive material for various industrial applications, including wiring, plumbing, motors, generators, transformers, computers, cars, heating and cooling systems.ĭue to its versatility and importance for many industries, the global demand for copper has been continuously growing over the past few decades. Join to be on top of the latest copper rate.Ĭopper is one of the most versatile metals available today. Trading copper offers substantial asset-class diversification, which can be an effective way to lower the overall volatility of a portfolio.Īccording to the historical copper price graph, the metal reached its record high of $4.63 in February 2011. Its utility coupled with a low price makes copper a low-risk investment favoured by international investors. Today, it is the world’s third-most-used metal, after iron and aluminium, and plays a pivotal role in all major economies and the developing world. US30 US Wall Street 30 (USA 30, Dow Jones)Ĭopper Follow our live chart to always keep up to date with the latest copper spot price.Ĭopper is a unique commodity that has a distinctive value in the global market due to its industrial worth.

0 kommentar(er)

0 kommentar(er)